How K-Pop Stars Became Fashion’s Biggest Darlings

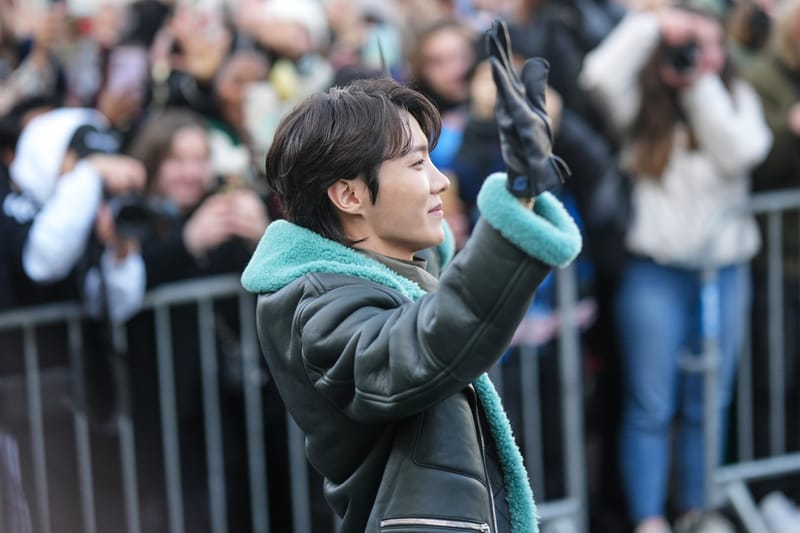

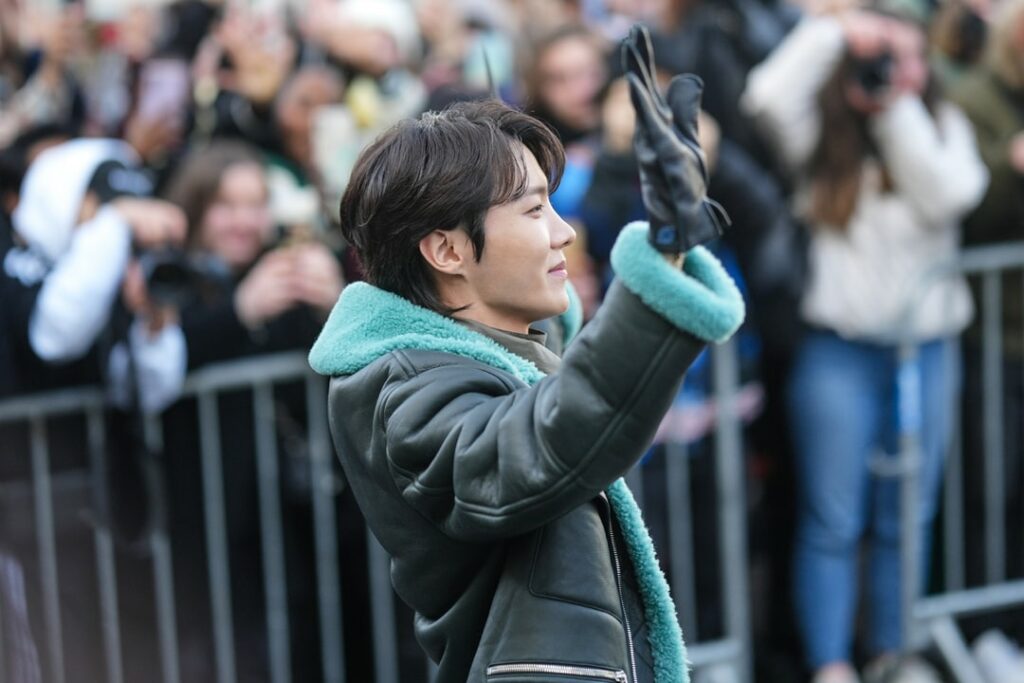

It’s just shy of 2:30 p.m. on Tuesday, September 26, and Dior’s Spring/Summer 2024 show is moments from claiming the Paris Fashion Week stage. The street outside the venue is packed with fans, and a black BMW 7 Series’ slow approach incites their feverish cheers. BLACKPINK’s Jisoo emerges from the vehicle with a four-man security detail, wearing the House’s latest designs and waving like a royal to the sea of unfamiliar faces that have been waiting just to catch a glimpse of her brisk excursion to the door from behind a comfortably-distanced barricade. This appearance, coupled with her front-row attendance at the show, garnered $1.6 million USD worth of media impact value (MIV), or online visibility. The echo mentions, or “buzz” surrounding her presence, added an extra $6.5 million USD to the total, according to online data platform Launchmetrics. In fact, Jisoo’s attendance at the Dior show alone earned more MIV than 86% of brands showcasing at the biannual fashion affair.

K-pop is this decade’s international music supernova: as it exploded from Seoul to the world, groups like BTS and BLACKPINK have corralled fandoms that level the likes of those for Beyoncé and Taylor Swift while smashing worldwide release charts and effortlessly selling out stadium tours. At first, the fashion industry was slow to welcome the South Korean stars into its notoriously exclusive circle (BTS only attended their first fashion show for Louis Vuitton in 2021, despite having debuted in 2013 and earned several No. 1 hits in the years prior), but once their inclusion was proven unprecedentedly valuable, the show invites, collaborations and ambassadorships came flowing in abundance.

In the last year alone, Cartier named BTS’ Kim Taehyung (otherwise known as V) its newest global ambassador; Loewe drafted NCT’s Taeyoung; Prada enlisted all seven members of ENHYPHEN; Valentino signed on BTS’ Suga, Versace partnered with Stray Kids’ Hyunjin; Givenchy snagged Taeyang; Dior employed BTS’ Jimin and later claimed the entire Tomorrow X Tomorrow group — and that’s just a handful of the partnerships that were announced. On the field, February’s fashion weeks saw the K-pop takeover manifest in full: NCT’s Johnny Suh sat at Thom Browne and Seventeen’s DK attended Bally, while BTS’ RM went to Bottega Veneta, BLACKPINK’s Rosé appeared at Saint Laurent, NCT’s Jeno was spotted at Ferragamo and BLACKPINK’s Jennie caused a ruckus at Chanel, just two months before launching a fully-fledged collaboration with Calvin Klein.

Jeremy Moeller/Getty Images

Soyeon Kim, the visual director of SM Entertainment, one of the biggest agencies managing K-pop talent, including the likes of NCT, EXO, Girls’ Generation, Red Velvet, and WayV, among others, tells Hypebeast that K-pop’s rapid, unparalleled success can be attributed to the “sense of unity” that connects the artists with the fans. “K-pop is an industry that has grown together with its fandom,” Kim says.

It’s true: K-pop stars famously endure a strenuous trainee program, which includes vocal, dance, acting and language classes that last for an indefinite period of time, all with the ultimate hope of debuting as an “idol” – and fans pay close attention to this process. “You can train with a management company for three or four years and be dropped at any time,” explains Matthew Cancel, founder of New York public relations agency, Cancel Communications. “It’s special for the fanbase to watch K-pop stars’ dreams come true in real time and feel like they are part of that story.”

“When you’re watching BLACKPINK perform, you almost respect them more because you know they fought so hard to get on that stage.”

Those that do debut are held to the highest standards of professionalism and perfectionism, thanks to the pillars of their training programs. It’s this discipline, this sportsmanship, this universal commitment to idealism that fascinates and hooks global audiences. “When you’re watching BLACKPINK perform, you almost respect them more because you know they fought so hard to get on that stage,” Cancel adds. “You cheer for them more. You know that these aren’t just four girls that were plucked out of obscurity or got a record deal based on some garbage TikTok song. These are four women that worked extremely hard for what they have.”

By the time September’s fashion weeks rolled around, fervent K-pop fans were well-prepared to scout out show locations and wait patiently behind metal bars to lay their eyes on their idols from afar. At Prada in Milan, for instance, crowds of hundreds turned to thousands: locals gathered with personalized signs at screeching volumes for ENHYPHEN’s arrival. Their attendance and show-related social media content garnered a total of $7 million USD in MIV. Echo mentions earned an additional $4.2 million USD in MIV, and in total, the band was responsible for 23% of the show’s MIV. Even more impressive, ENHYPHEN alone raked in more online attention than 91% of the shows at Milan Fashion Week.

To draw a comparison, Kim Kardashian’s Dolce & Gabbana collaboration and runway show last year earned digital visibility worth $4.6 million USD. Kardashian, herself one of the world’s most-known individuals, had to curate and style an entire 85-piece collection to reach that figure. ENHYPHEN merely put on Prada’s clothes, sat at the brand’s show and posted on their social media accounts — and still accumulated $2.6 million USD more than the reality star. Take from that what you will, but the numbers don’t lie: there’s no bigger draw than these K-pop stars.

Edward Berthelot/Getty Images

K-pop artists are indisputably and fiercely talented entertainers, but it’s the fan behavior that surrounds their enterprise — which is expected to generate $20 billion USD by 2031 — that sets them apart in the eyes of brands. In the first half of 2023, K-pop stars claimed five of the top 10 spots on the list of most-followed accounts by average MIV. BLACKPINK’s Lisa ranked second with an average MIV of $1.9 million USD, behind KAROL G, who boasts a whopping $28.8 million USD average MIV. Jennie ($1.7 million USD), Rosé ($1.6 million USD) and Jisoo ($1.6 million USD) took fifth, sixth and seventh, respectively, while BTS’ V rounded out the top 10 with $1.4 million USD.

The word “idol” is important to note, as K-pop singers are carefully positioned to be idolized. Unlike many American artists, like Taylor Swift, for instance, who has mastered the parasocial relationship with her fans and is often photographed in her daily life, K-pop stars are purposefully unreachable and untouchable. “The entertainment structure is different,” says Cancel. “K-pop stars are supposed to be on top of the world. They are larger than life, and they are so protected. You don’t see them out and about as much, so when they show up to a fashion show, it’s very exciting and people get highly overwhelmed.”

K-pop artists are personally elusive and professionally omnipresent. Sure, there’s an endless amount of K-pop content to consume online — be it music videos, fan cams, variety shows, interviews or tour vlogs. But there’s an intentional mysteriousness to these artists’ private lives that keeps their star power at a continuous high. This duality ensures their brand-safeness, and that, coupled with their massive followings and high-octane talent, makes them ideal partners for luxury fashion houses. This picture-perfect image, however, is all part of the management companies’ capitalist strategies, which ultimately prioritize maximizing profits by treating artists like fully-manicured, marketable commodities, whose individual personalities take a backseat to their image. Under characteristically exploitative circumstances, perhaps K-pop stars hold onto their personal lives because they are the only things they can fully control themselves.

“K-pop stars’ constant media visibility, cross-cultural appeal, versatility in various talents, youthful energy, and strong social media presence make them attractive to brands.”

In the last several years, fashion-conscious consumers have shifted their focus to “diverse cultures beyond their borders” for inspiration, which has resulted in “K-Pop stars being embraced as strategic brand partners,” according to Alison Bringé, chief marketing officer at Launchmetrics. “K-pop stars’ constant media visibility, cross-cultural appeal, versatility in various talents, youthful energy, and strong social media presence make them attractive to brands seeking to connect with younger, diverse demographics and capitalize on their substantial influence in the entertainment industry.”

As brands look to reach younger generations of consumers across international markets, K-pop stars offer a first-of-their-kind ambassadorship, as the inaugural AAPI supergroups to harness the globe at this level. “We’ve seen the American Dream, white-girl-rises-to-fame thing happen a million different times, but we have never seen AAPI superstars break into global dominance until recently,” says Cancel. Gen Z and millennial consumers, both those who are seeing themselves represented in music at this scale for the first time and those who are simply fans of K-pop music, are significantly more likely to purchase from a brand endorsed by the genre’s idols, as proven by their ultra-high MIVs. This philosophy is exactly why you saw BTS’ Jimin star in Dior’s Spring/Summer 2024 campaign last week, and it’s the reason five-member girl group LE SSERAFIM became Louis Vuitton’s latest house ambassadors in the week prior.

Jacopo Raule/Getty Images

Fashion’s most sought-after stars are always changing: supermodels stole the ‘90s; actors prevailed in the 2000s; and hip-hop artists took centerstage in the 2010s, prior to the flood of influencers. There’s no saying how long K-pop’s industry reign will last, though it’s safe to say their pop-cultural grip is undying.

“I think, in five to six years from now, we’re going to see K-pop stars start to break the mold, do their own thing, and maybe even sign with U.S.-based agencies,” Cancel predicts. In order to stay afloat in fashion’s top circle, K-pop stars will need to retain their cultural relevance; and oftentimes, artists face pressure to evolve their identities, or to find “newness” in themselves, in order to do just that. Perhaps Cancel’s theory is correct, and we’ll see an influx of U.S.-bred K-pop artists experimenting with Westernized public relations strategies down the line; or maybe the K-pop machine will remain just as squeaky clean as it is today. Either way, the smart money is on K-pop stars taking fashion’s front row seats for quite some time longer.

Source: Read Full Article